Discover NVIDIA Results Q3, highlighting key financial metrics, growth trends, and insights into future performance. Stay informed on market developments.

Also, read Easy and Fast Fluffy Pancakes Recipe

Here’s an article covering the latest updates on NVIDIA Corporation (ticker: NVDA) — its Q3 2026 results, outlook, and what it means for the company and the broader AI-chip market.

NVIDIA Results Q3: Strong Q3 Performance

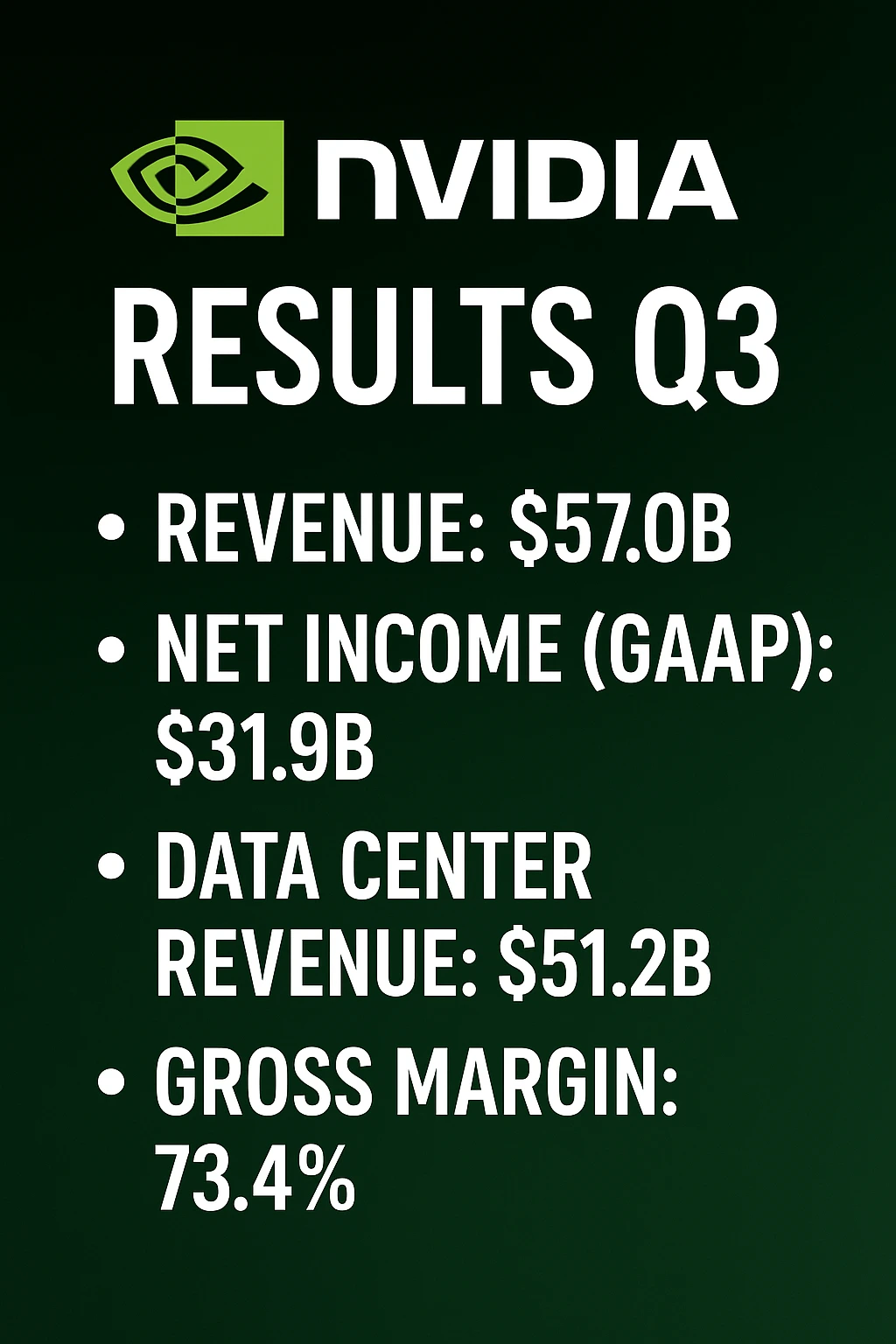

Nvidia reported its third quarter of fiscal 2026 (ending October 26, 2025) with standout numbers:

- Revenue: US $57.0 billion, up ~22 % quarter-on-quarter and ~62 % year-on-year. (NVIDIA Investor Relations)

- Net income (GAAP): ~US $31.91 billion, up ~65 % from the same period a year ago. (mint)

- Data centre segment revenue: US $51.2 billion, a ~66 % rise year-on-year and ~25 % up quarter-on-quarter. (NVIDIA Investor Relations)

- Gross margin: about 73.4 % (GAAP) with non-GAAP at ~73.6 %. (NVIDIA Investor Relations)

These figures show Nvidia is riding the AI tailwinds strongly and hitting major growth in its core segments (data-centres, AI chips) rather than just incremental gains.

Key Drivers & Business Highlights

Several factors underpin Nvidia’s strong performance:

- Huge demand for its advanced AI-architectural chips (notably the “Blackwell” architecture) and server‐/GPU systems for AI workloads. Nvidia’s CEO Jensen Huang said “Blackwell sales are off the charts, and cloud GPUs are sold out.” (NVIDIA Investor Relations)

- Increasing enterprise, cloud and industrial AI deployment: training and inference workloads are scaling rapidly according to Nvidia. (mint)

- Growth beyond just gaming: While gaming revenue was lower (or flat) compared to data centre, Nvidia’s push into automotive, robotics and edge AI also featured in the results. (NVIDIA Investor Relations)

In short: Nvidia is more than just a graphics-card company now — it’s deeply embedded as a key AI infrastructure provider.

NVIDIA Results Q3: Outlook & Forward Guidance

One of the most attention-grabbing points: Nvidia’s forecast for the coming quarter.

- For Q4 FY26, Nvidia expects US $65.0 billion in revenue (±2 %). (NVIDIA Investor Relations)

- Gross margins are guided to ~75 % (non-GAAP) for that quarter. (NVIDIA Investor Relations)

This outlook exceeds many analysts’ expectations and signals that Nvidia believes the AI-driven demand has more runway.

NVIDIA Results Q3: Market Reaction & Broader Implications

- Nvidia’s stock jumped in after-hours trading following the results and guidance. (Investopedia)

- The strong results helped boost sentiment in broader tech markets (especially in Asia). (AP News)

- Importantly, the results are seen as a vote of confidence in the AI infrastructure boom — but also trigger questions about sustainability. (Reuters)

NVIDIA Results Q3: Risks & Things to Watch

Despite the strong numbers, several caution points remain:

- Concentration of customers: A small number of customers contribute a large share of revenue; this may increase business risk. (Reuters)

- Infrastructure bottlenecks: Power, data-centre capacity, supply-chain constraints could limit how fast AI compute can scale. (Reuters)

- Geopolitical & export issues: Nvidia is somewhat constrained in certain markets (e.g., China) due to export rules, which could limit growth. (Reuters)

- Valuation / bubble concerns: Some analysts caution whether the pace of growth is sustainable and whether AI hype is outpacing fundamentals. (Financial Times)

NVIDIA Results Q3: What This Means for India / Global Markets

For investors and observers in markets like India (or globally):

- Nvidia’s results reaffirm that the AI infrastructure demand cycle is intensifying — this may benefit vendors, cloud providers, software companies and ecosystem players.

- For companies in India tied to AI hardware, cloud, data-centres or edge computing, this is a signal that the ramp-up is real, not just hype.

- On the flip side, the risk side suggests being selective — hardware supply chains, power/data-centre logistics and customer concentration matter.

- From a broader market perspective, Nvidia is increasingly being seen as a bellwether for AI-infrastructure health. The strong results could buoy tech stocks globally.

NVIDIA Results Q3: Summary

Nvidia delivered a powerful Q3: ~US $57 billion revenue, massive year-on-year growth, and a bullish outlook (~US $65 billion in Q4). Its data-centre/AI segment is doing heavy lifting. The market has responded well, and the results have helped partially address concerns of an “AI bubble.” Nonetheless, risks remain — especially around sustainability of growth, concentration of business, and infrastructure scaling.

For anyone tracking AI-hardware, cloud infrastructure or the broader tech ecosystem, Nvidia’s results are a major datum point.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.